Investing in Uranium

/)

/)

Investing in Uranium and Uranium Mining Funds

Key takeaways:

- Uranium market volatility is highly influenced by geopolitical shifts.

- Uranium reduces fossil fuel reliance and will be essential for the green transition.

- Rising demand and limited supply highlight uranium's investment potential.

- Technological innovations enhance uranium's sustainability and efficiency.

Invest in uranium

Invest in uranium with AuAg

AuAg Funds recognizes the undeniable potential of uranium as a pivotal resource for the future, especially in overcoming the EU's energy challenges. Our investment strategy concentrates on uranium miners within the Western world that adhere to sustainable practices. Currently, our portfolio includes investments in Canadian and American mines, and we are poised to expand our investments to include additional uranium mining companies in Europe as soon as opportunities arise.

AuAg Essential Metals

Our fund, AuAg Essential Metals, invests 8% in uranium, focusing exclusively on producing or near-production mines to ensure immediate impact and growth potential.

/)

Why invest in uranium?

- The green transformation: Nuclear energy may be a necessity for the green transformation.

- A sustainable energy solution: Uranium stands out as one of the most sustainable alternatives to fossil fuels, offering a path to meet the increasing energy demands while adhering to environmental goals.

- Unique market dynamics: Uranium's market dynamics are notably distinct from other commodities. Its value is not directly tied to the fluctuations of the stock market or precious metals, making it an isolated investment avenue.

- Long-term demands: The long-term contracts between nuclear plants and sellers typical in the uranium market, alongside the longevity of nuclear reactors (~50 years), ensure a consistent demand for uranium.

- Supply-demand imbalance: With more reactors being constructed than the current uranium supply can support, a significant increase in uranium mining is imperative. This supply-demand imbalance is poised to drive uranium prices to unprecedented highs.

How and where is uranium used?

Energy production

The most well-known use of uranium is in nuclear power plants for electricity generation. Uranium undergoes a process called fission in nuclear reactors, where its atoms are split to release a tremendous amount of heat. This heat is then used to generate steam, which drives turbines to produce electricity. Nuclear power provides a significant portion of the world's clean, carbon-free electricity, making uranium energy a key player in the global energy mix aimed at combating climate change.

Medical applications

Uranium's radioactive properties make it useful in medicine, particularly in radiotherapy for treating cancer. Uranium isotopes are used to produce radionuclides, which are vital in diagnostic imaging and targeted radiation treatments.

Space exploration

Uranium's application extends to space exploration, where Radioisotope Thermoelectric Generators (RTGs) use the heat released by the decay of uranium to produce electricity for spacecraft. This technology provides power to missions in remote areas of space where solar energy is not viable.

Is uranium a good investment?

The question of whether uranium investing is good or not hinges on a variety of factors, including individual risk tolerance and investment strategy. It's not advisable to allocate all your investment capital into uranium, rather, it should be considered as part of a diversified portfolio.

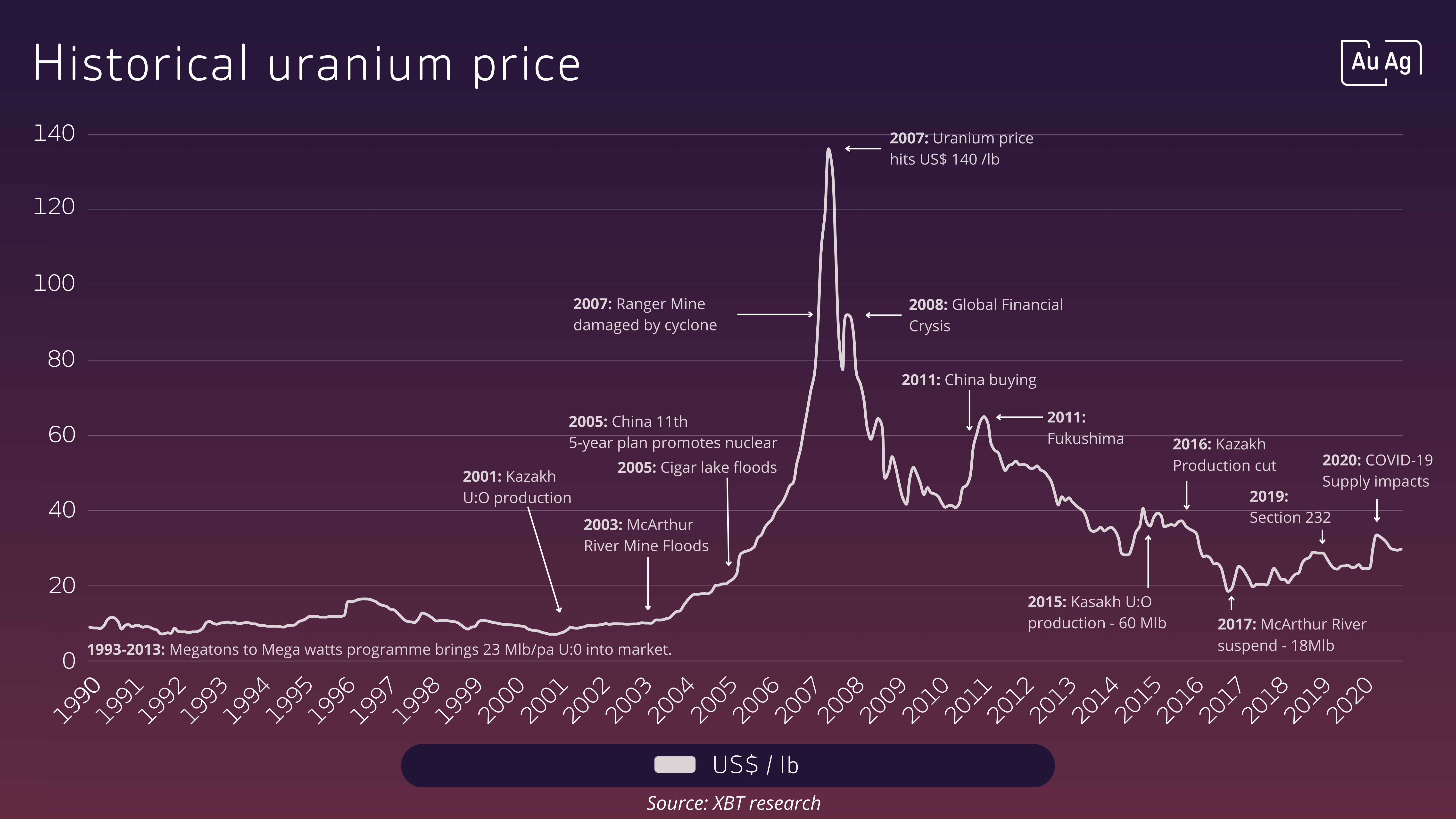

Investing in uranium has historically offered significant returns during certain periods. However, like any commodity, it experiences cycles of highs and lows, influenced by market demand, geopolitical tensions, and advancements in nuclear technology. Uranium is grounded in the real-world demand for nuclear energy – a stable and growing source of clean energy. In Sweden, for example, nuclear power accounts for around a third of the energy mix, trailing only behind hydropower and ahead of wind energy.

Why invest in uranium mining companies?

Investing in uranium mining companies offers leveraged exposure to the uranium market. Similar to the dynamics in the gold market, uranium miners tend to benefit directly from the rises in uranium prices. As the price of uranium increases, so does the potential profitability of uranium mining companies, which can lead to an increase in their stock prices.

When should you invest in uranium?

The uranium market is known for its volatility, with prices fluctuating significantly over short periods. This characteristic suggests that investing in uranium may be best approached with a long-term perspective, buying incrementally over time to mitigate the impact of price volatility. Despite the short-term fluctuations, the overarching trend indicates an upward trajectory in uranium prices, largely driven by increasing demand for nuclear energy as part of a cleaner, more sustainable future.

How to invest in uranium?

Actively managed funds

Actively managed funds, such as those offered by AuAg, are a common and accessible way to invest in uranium. These funds are managed by professionals who conduct in-depth analysis to select uranium companies that demonstrate strong growth potential and sustainable practices in the sector.

Exchange-Traded Funds (ETFs)

ETF uranium stocks are generally less accessible than actively managed funds because they may not be available on all investment platforms across different countries. These funds aggregate a range of uranium mining and exploration companies to offer investors an opportunity to invest in uranium through a single transaction.

Price of uranium

The chart shows the price of uranium futures.

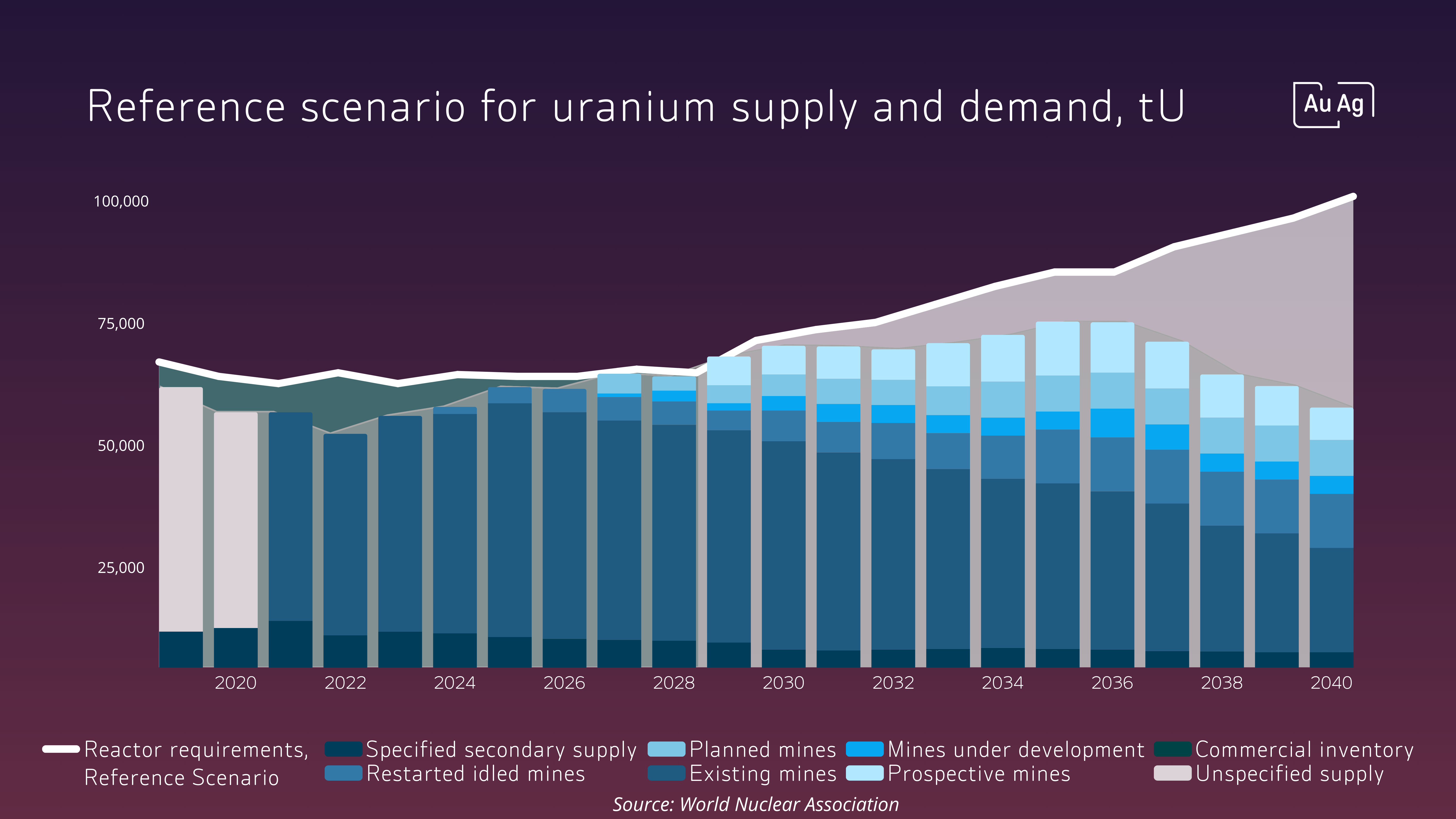

Supply and demand of uranium

The supply of uranium

Uranium is mined in over 20 countries, with Kazakhstan, Canada, Namibia, and Australia leading in production. These countries together account for a significant portion of the world's uranium supply (~78%). A secondary type of uranium supply exists – from decommissioned nuclear weapons, inventory drawdowns, and recycled reactor fuel – contributing to the global uranium market. However, these sources are finite and subject to geopolitical considerations, highlighting the importance of robust mining operations.

- Mines supplied about 56,961 tonnes of uranium oxide in 2021, fulfilling 74% of the demand.

- Secondary sources, including utility stockpiles, made up the shortfall. Stockpiles were estimated at about 40,000 tonnes in - Europe and the USA, 130,000 tonnes in China, and 60,000 tonnes in other Asian countries as of end-2020.

- Russia and China have invested in foreign uranium mines to secure supply, emphasising strategic over cost considerations.

- Early uranium production initially for military use has historically addressed supply shortfalls, with the gap now narrowing due to continuous secondary supplies.

- Future projections account for mine capacity and secondary sources, adjusting for recent production dips due to price drops and the pandemic.

Source: World Nuclear Association

The demand for uranium

The future of uranium is intricately linked to its role in nuclear power generation, a sector experiencing nuanced shifts in demand, efficiency improvements, and technological advancements. Here are some critical insights into uranium's demand dynamics and its broader implications:

- Around 440 reactors worldwide require 74,000 tonnes of uranium oxide concentrate each year.

- Efficiency improvements in the past decades have moderated uranium demand despite capacity growth.

- New reactor capacity increases uranium demand by approximately 150 tonnes for operation and 300-450 tonnes for initial fueling.

- Uranium demand is relatively stable due to nuclear power's cost structure, favoring long-term operational continuity.

- Projections indicate a 27% increase in uranium demand by 2030 and a 38% increase from 2031-2040, driven by new reactor constructions and electricity demand recovery.

Source: World Nuclear Association

The future of uranium

The landscape of uranium and nuclear/uranium energy is entering a transformative era, shaped by the global pursuit of energy independence, anticipated market dynamics, technological advancements, and the expansion of nuclear infrastructure.

New reactors are being established

There are about 440 active nuclear power reactors globally today, operating in 32 countries. Many countries with a nuclear program have plans to or are building new power reactors. A total of 170 new reactors are to be constructed in the next couple of years. See the full list on the World Nuclear Association website.

Becoming energy independent

Due to the situation with Russia, Europe is putting emphasis on achieving energy independence, with uranium playing an important role. The shift towards nuclear power as a reliable and clean energy source will, in the future, most likely drive countries to secure stable uranium supplies, minimising reliance on geopolitically sensitive imports.

Expect a new price record

The convergence of growing demand, tightening supply, and geopolitical factors suggests that uranium prices could reach new highs. As the nuclear sector expands and stockpiles from previous years dwindle, the market is poised for significant price adjustments.

Innovation in nuclear energy

From advancements in fuel efficiency and safety to the development of small modular reactors and breakthroughs in fusion energy, the sector is witnessing a renaissance. These innovations promise to enhance the sustainability, efficiency, and public perception of nuclear power:

- Alternative coolants and fuels: There's a shift from traditional water-cooled and uranium-fueled reactors towards using alternative coolants like molten salts, liquid metals (sodium and lead), and gases (helium) that can operate at lower pressures and higher temperatures.

- TRISO fuel: This fuel type, consisting of uranium particles encased in ceramic and carbon layers, is gaining popularity for its high resistance to extreme temperatures and its containment of fission products.

- Small Modular Reactors (SMRs): SMRs are a focal point due to their potential for lower initial capital costs, enhanced safety features, and flexibility in location and scale. They can be prefabricated and shipped to the site, reducing construction time and cost.

Why invest in uranium with AuAg Funds?

- AuAg Funds offers funds that focus on providing exposure to precious metals and elements within green technology. What they have in common is that these assets offer protection against monetary inflation and are necessary in the transition to a green world – trends that are highly topical today.

- AuAg's fund, AuAg Essential Metals, invests in uranium mining companies and fits well into a portfolio of traditional assets as they have low co-variation with shares.

Uranium is a heavy metal with the highest atomic weight of the naturally occurring elements. It is well-known for its use as fuel in nuclear power plants due to its ability to undergo fission, where its atoms are split to release a significant amount of energy.

/)